On July 18, the EU finally adopted its long-delayed 18th package of sanctions on Russia, focusing heavily on the oil trade, but which also includes punitive steps against third country companies and banks that enable sanctions evasion as well as further measures to blacklist and immobilize the so-called “shadow fleet” that has long supported Russia’s oil exports.

According to the European Commission, the new measures zero in on five building blocks: cutting Russia’s energy revenues, hitting Russia’s banking sector, further weakening its military-industrial complex, strengthening anti-circumvention measures, and holding Russia accountable for its crimes against Ukrainian children and cultural heritage. With the 18th package, the number of listed vessels in Russia’s shadow fleet reaches a total of 444 vessels, and the number of individual listings exceeds 2,500. This package also includes new sanctions against Belarus.

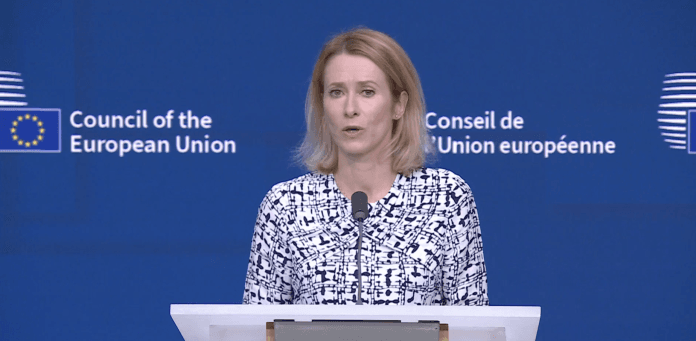

“The EU just approved one of its strongest sanctions packages against Russia to date,” EU High Representative Kaja Kallas wrote on X. “We will keep raising the costs, so stopping the aggression becomes the only path forward for Moscow.”

Russia’s hybrid attacks won’t go unanswered.

— Kaja Kallas (@kajakallas) July 18, 2025

The EU, UK & partners continue to take coordinated action, including with sanctions.

We will use all available tools to protect our institutions, infrastructure, and democracies.

Statement on behalf of EU27: https://t.co/NkXJJM6rVr pic.twitter.com/5QpAGOT4Hg

President Volodymyr Zelenskyy of Ukraine noted “This decision is essential and timely, especially now, as a response to the fact that Russia has intensified the brutality of the strikes on our cities and villages.”

Agreement on the new EU package was held up for close to a month as Slovakian Prime Minister Robert Fico demanded concessions on a separate EU plan to phase out dependence on Russian oil and gas, which he only partially received. Greece, Cyprus, and Malta had also expressed concerns about the effect of the oil price cap on their shipping industries. But Malta, the last of the trio to hold out, changed course on July 17. Fico announced late on July 17 that he was ending his opposition to the package.

While the 18th package (key elements summarized below) looks impressive and is being sold as one of the toughest EU sanctions packages yet, it is essentially a continuation of the ongoing dynamic practice since 2022 of announcing sanctions and then identifying weak spots, patching them and moving to the next newly identified weak spot as evaders open new routes. Most of those weak spots are in energy trade and transport as well as the banking sector.

Where is Washington on new sanctions?

Moving ahead without the U.S. in lockstep, as Washington is in a 50-day “countdown” to end the war imposed by President Trump earlier in July, presents a new set of challenges. There is also the possibility that use of the U.S. banking system for payments by firms driven out of third markets by the new EU sanctions will increase in this period.

It should not be forgotten that the American “Sanctioning Russia Act of 2025” has gathered bipartisan supermajority support in both houses of the U.S. Congress. President Trump has indicated a willingness to sign the bill at some point but wants expanded presidential waiver authority added. Some European leaders see the U.S. legislation and the new EU package as “The Perfect Storm,” and movement on both fronts would no doubt increase pressure on Moscow for a Ukraine peace deal.

Key elements of the new EU package:

Energy measures

Lowering of the Oil Price Cap for crude oil by 15 percent from the current global average of $60 per barrel to $47.6, and introduction of an automatic and dynamic mechanism for its review in the future. The new system will ensure that the cap is always 15 percent lower than the average market price for Urals crude in the previous period of six months, resulting in both predictability for operators and downward pressure on Russian energy revenues.

Transaction ban for Nord Stream 1 and 2: This means no EU operator can engage in any transaction regarding the Nord Stream pipelines.

Import ban on refined oil products derived from Russian crude: This means a clampdown on refined product imports made from Russian crude that are processed abroad and delivered into the EU. This will prevent Russian crude oil from reaching the EU market in any form.

105 additional vessel listings, meaning that a total of 444 vessels in Russia’s shadow fleet are now listed by the EU. Three LNG tankers have been delisted following firm commitments that these vessels will no longer engage in the transport of Russian energy to the Russian Yamal and Arctic 2 projects. Listed vessels are subject to a port access ban and a ban on receiving services. Alongside the listings of these unseaworthy tankers, the EU is conducting outreach to flag states to ensure that ship registers do not allow these tankers to sail under their flag.

Full-fledged listings – asset freezes, travel bans – throughout the shadow fleet value chain. These target both Russian and international companies managing shadow fleet vessels, traders of Russian crude oil, as well as a major customer of the shadow fleet, a refinery in India with Rosneft as its main shareholder. For the first time, the EU is designating a captain of a shadow fleet vessel as well as an operator of an open flag registry. One entity in the Russian LNG sector is also included in the new listings.

Financial measures

Transforming the ban on provision of specialized financial messaging services with certain Russian banks into a full transaction ban: This means EU firms are banned from doing any business, including providing specialized messaging services subject to this measure so far, with the 23 listed entities.

Adding another 22 Russian banks to this transaction and messaging ban, bringing the total to 45. No EU operator will be able to engage with any of the listed banks directly or indirectly, including providing specialized messaging services.

Broadening the transaction ban for third-country financial operators, including crypto-asset providers who help circumvent sanctions, support Russia’s war of aggression against Ukraine, or are connected to Russia’s financial messaging service. EU operators are banned from carrying out transactions with any of those financial operators.

New transaction ban targeting the Russian Direct Investment Fund (RDIF), its subsidiaries, its investments and financial institutions supporting them. The new measures prohibit engaging with any legal person, entity or body in which the RDIF holds any ownership or investments. This will prevent Russia from using the RDIF to access global financial markets, circumvent EU sanctions, obtain foreign currency, sustain its war effort, or increase the resilience of its economy. This package targets four companies in which the RDIF has invested, helping economic operators with implementation and compliance.

Ban on provision of certain banking software: The prohibition on provision of services and software to the Russian Government and to Russian companies will now include key types of banking software.

Trade measures

The package expands export restrictions and bans to further disrupt and weaken Russia’s military-industrial complex. These include:

Restrictions on additional advanced technologies;

Further export bans that correspond to almost 2.1 billion euros of exports in 2024 terms.

Anti-circumvention measures

This package adds 26 entities to the list of those providing direct or indirect support to Russia’s military industrial complex or engaging in sanctions circumvention. This includes 15 entities established in Russia and 11 in other third countries (four in Turkey and seven in China/Hong Kong). Annex IV lists companies which are military end-users, or those which form part of, or have close links to, the Russian military-industrial complex and for which even tighter restrictions apply.

The transit ban is expanded by adding eight Combined Nomenclature (CN) codes from the list of Economically Critical Goods – updated on 24 February 2025 – used for construction and transport, two of which are of direct relevance to the energy industry. In practice this means that those goods can no longer transit the territory of Russia when exported from the EU to third countries.

The package also introduces a dedicated catch-all provision to address the risk of circumvention via third countries of exports of advanced technology items. This will provide Member States with an additional tool to stop and investigate suspicious shipments and prevent the circumvention of sanctions.

Targeting military capabilities and supply chains

The new package contains 55 additional listings. These listings target the military industrial complex with a view to curb Russia’s military capabilities. To further constrain its access to goods and technologies, listings target the supply chain of the Russian military industrial complex, including through the listing of companies in China supplying goods used on the battlefield. Additionally, the package targets eight companies operating in the Belarusian military industrial complex, which is supporting Russia’s war efforts.

Russia’s accountability

By adding another individual actively involved in Russia’s “military education” of Ukrainian children, the EU continues to target those responsible for the indoctrination of Ukrainian children. It brings the total number of designations in relation to the deportation and indoctrination of Ukrainian children to over 80.

The package is also listing several Russian proxies in occupied territories, including a person responsible for manipulation of Ukrainian cultural heritage, another leading Russian businessperson, and a prominent Russian propagandist.

Measures to protect Member States from arbitration

Introduction of protective restrictions concerning the investor-to-state dispute settlement (ISDS): These new measures address the risk of economic damage from investment arbitrations launched by listed persons in relation to EU sanctions. The measures provide further protection for Member States from sanctions-related claims under their bilateral investment treaties (BITs). This includes the possibility for Member States to recover any damages incurred as a consequence of investor-to-state dispute settlement proceedings brought against them.

New measures against Belarus

In parallel, the package includes additional measures on Belarus, namely prohibiting arms procurement from Belarus, adding a catch-all provision for advanced technology items, transforming the ban on specialized financial messaging services into a full transaction ban, and adding measures to protect Member States from arbitration.

This package also includes additional export restrictions on sensitive goods, technologies and industrial goods. Finally, it adds one (1) entity subject to restrictions and eight (8) additional entities subject to asset freezes.